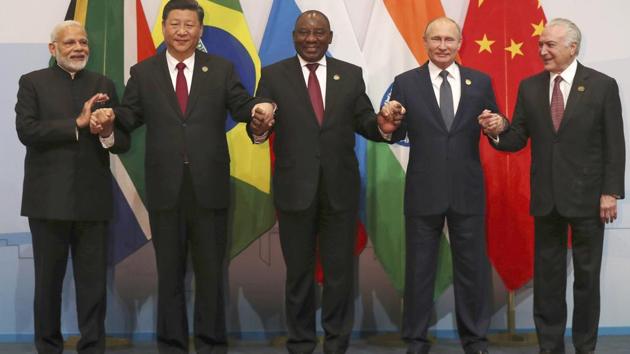

Why BRICS Countries Are Cutting Dollar Dependence and Buying Gold

Related Articles

Delhi Chief Minister Initiates Rs 264 Crore Development Projects in Mundka

Chief Minister Rekha Gupta on Tuesday inaugurated the foundation stones for development projects valued at Rs 264 crore in Mundka, emphasising the government’s commitment...

Indian-Origin Restaurateur to Close Rangrez in London After 16 Years: Cause Harassment

An Indian-origin restaurateur based in London has announced the impending closure of his restaurant after 16 years of operation, citing a multitude of difficulties....

Trump Claims Hospital Ship En Route to Greenland, Navy Denies Orders

The Pentagon has indicated that there were no orders issued to send a hospital ship to Greenland, despite claims made by President Donald Trump...