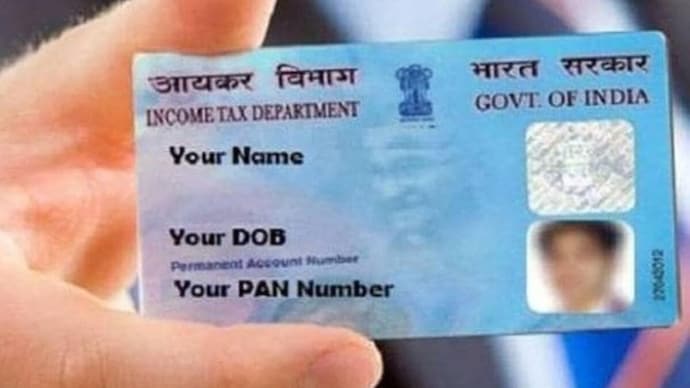

India Proposes Major Changes To PAN Rules In Draft 2026 Tax Regulations

Related Articles

Gen Z is Transforming Beverage Culture: From Boba to Matcha

Young consumers from Generation Z are redefining their drink choices, moving away from traditional flavors in favor of more experimental and meaningful options. This...

नाबालिग का सिर कुचला, खून पिया, भेजा खाया-दामोह के नरपिशाच की खौफनाक करतूत

दमोह में खौफनाक वारदात ने मचाया हड़कंप

मध्य प्रदेश के दमोह जिले में एक दिल दहला देने वाली घटना सामने आई है, जहां एक व्यक्ति ने...

धर्मांतरण विरोधी कानून को मिली महाराष्ट्र सरकार की मंजूरी, जानें इसकी खास बातें

जबरन धर्मांतरण के खिलाफ सख्त कानून का ऐलान

महाराष्ट्र कैबिनेट ने हाल ही में धर्मांतरण विरोधी विधेयक को मंजूरी दी है। इस नए कानून के...