Purchasing a term insurance policy can seem confusing when you use phrases such as “premium,” “coverage,” and “sum assured.” But the process doesn’t have to be confusing. With some proper advice, anybody can realise how much life insurance is going to cost and why. One of the simplest resources to get a good idea is a term insurance premium calculator. It assists you in approximating your annual or monthly payment for a policy without guessing. You just need to fill in a few details, such as your age, income, and the protection you require. Within a couple of seconds, you can know how much you’ll pay for fiscal protection.

What is a Term Insurance Premium?

Let us first know what a premium is. In plain language, a premium is the amount you pay the insurance company to maintain your plan. You can consider it as a subscription to financial security. Pay it periodically, and your family receives the guaranteed amount if anything untoward happens to you. Don’t pay it, and the cover ceases.

The premium amount varies based on numerous factors, including:

-

Your age

-

Your health status

-

The amount of cover (sum assured)

-

Your personal habits, such as smoking or alcohol use

Why choose ₹1.5 Crore Term Insurance?

A 1.5 crore term insurance policy is perfect if you wish to secure your family’s future. Suppose your family needs funds to repay a home loan, children’s education, and day-to-day expenses. A 1.5 crore cover can provide them with a financial buffer and mental peace. Selecting the proper sum assured is critical. It must be sufficient enough to replace your income and take care of major expenses, but not so much that the premium price becomes unsustainable.

Step 1: Determine Your Coverage

The initial step towards determining premiums is determining the coverage you require. An approximate principle to follow is to calculate 10 to 15 times your annual income. For instance, if you earn ₹10 lakh yearly, a 1.5 crore cover is a good option. This will make sure that your family is able to keep their way of life even in case of your absence.

Step 2: Select the Policy Term

Then, determine the duration for which you want the protection. This is referred to as the policy term. Most individuals select a term until retirement age, around age 60 or 65. Therefore, if you are age 30, a 30-35 year term would be fine. A longer term may cost you a few dollars more each month, but it covers you for a long time.

Step 3: Consider Your Age and Health

Age contributes a lot towards the calculation of premiums. Young individuals pay less in premiums as they are less prone to serious health issues. If you live healthily, don’t smoke, and have a clean health record, your premium will be even less. Certain insurance companies also request medical tests if you need a very high coverage, such as 1.5 crore, to evaluate risk.

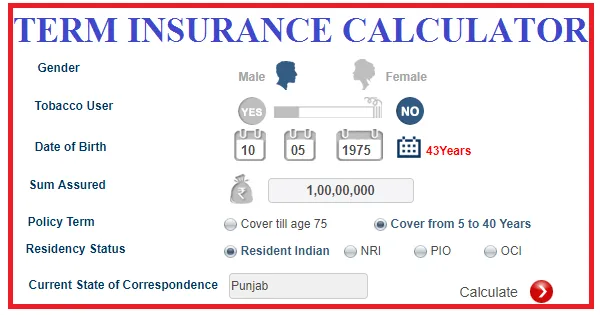

Step 4: Use a Term Insurance Premium Calculator

This is where the magic comes in. It’s easy to use a term insurance premium calculator. Simply input:

-

Your age

-

Gender

-

Health status

-

Coverage amount (sum assured)

-

Policy term

The calculator immediately displays your approximate premium. Experiment with combinations until you find one within budget. Much quicker than calling individual insurance companies or making an educated estimate.

Step 5: Compare Plans

Even after you use the calculator, don’t stop there. Different insurance companies can offer different premiums for the same policy. Check out more than one plan, compare the benefits, and check if there are extra features such as critical illness cover or accidental death benefit. This way, you get the maximum value for your money.

Step 6: Consider Riders and Add-Ons

Most term policies have optional riders or add-ons. These will cost a little extra, but give added coverage. Some popular riders are:

-

Accidental death benefit

-

Critical illness cover

-

Waiver of premium in the event of disability

Consider whether these add-ons are worth the added premium. Occasionally, an added premium of a little can give big peace of mind.

Step 7: Check for Tax Benefits

One of the largest benefits of term insurance is that premium payments are tax-exempt under Section 80C of the Income Tax Act. Moreover, the sum assured received by your family is free of tax. So, determining the premium isn’t just for your pocket; it’s also for saving on taxes and securing your family’s future.

Step 8: Understand Renewal and Payment Options

Most term plans have flexible payment choices. You can pay yearly, half-yearly, or every month. Some individuals would like a single premium for the whole term, though it is costly initially. Select a mode of payment convenient for your cash flow. Also, look for whether the plan can be renewed at the end of the term if you wish to have coverage post-retirement.

Example of Computing a Premium

Suppose you are 35 years old, healthy, non-smoker, and wish to buy a 1.5 crore term insurance policy for 30 years. According to an online term insurance premium calculator, you may find:

-

Annual premium: ₹25,000 – ₹30,000

-

Monthly premium: ₹2,100 – ₹2,500

This is an approximation. Actual premiums will differ slightly based on the company and your medical reports. But it gives a clear idea that high coverage does not necessarily mean exorbitant premiums.

Tips to Reduce Your Premium

If your estimated premium exceeds your pocket, try these tips:

-

Select a lower cover – Rather than 1.5 crore, try 1.2 crore.

-

Opt for a short duration – Cover till retirement or till outstanding loans are settled.

-

Keep good health – Non-smokers and health-conscious individuals receive lower rates.

-

Utilize online plans – Purchasing online is generally more affordable than offline.

Conclusion

It appears to be complicated to calculate premiums for a term insurance policy at first. But with proper methodology, it’s simple. Set the coverage, select the policy duration, keep your health in mind, and apply a term insurance premium calculator. Remember to compare policies, verify add-ons, and consider tax benefits. A 1.5 crore term insurance policy can provide your family with financial security and tranquility.

Remember, life insurance is not just a policy; it’s a promise to protect your loved ones. Take the time to understand your needs, calculate your premiums carefully, and choose a plan that fits your budget. The right plan today can secure your family’s tomorrow.