Rajpal Yadav has recently received a six-month prison sentence related to a case of cheque bounce. This legal situation highlights significant aspects of laws surrounding loan repayment and cheque dishonor in India.

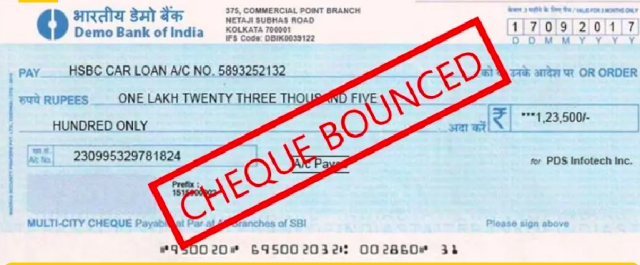

Under the Negotiable Instruments Act, 1881, if a cheque is returned due to insufficient funds or if the account is closed, it constitutes a cheque bounce. The party who receives the cheque can file a complaint against the issuer if the cheque is not honored. The involved parties must understand their rights and obligations to navigate such situations efficiently.

Legal Implications of Cheque Bounce

The penalties imposed for cheque bounce are clearly outlined in the legal framework. If found guilty, the issuer can face a punishment of imprisonment for a term that may extend to two years or a fine that can be double the amount of the cheque, or both. All offenses under this law are cognizable, allowing the police authority to arrest the issuer without a warrant. It is crucial for individuals to ensure that sufficient funds are maintained in their accounts when issuing cheques to avoid such complications.

Loan Repayment Obligations

In regards to loan repayments, borrowers are legally required to adhere to the terms and conditions set forth during the lending agreement. Failure to repay loans can lead to adverse consequences, including legal action by creditors. If a borrower defaults on a loan, the lender has multiple remedies available under the Indian legal system, including filing a suit for recovery of the loan amount.

In the case of personal loans, if the borrower fails to make repayment as per the scheduled timeline, the lender could initiate legal proceedings to recover the amount owed. This may also lead to the garnishment of wages or seizing of assets, depending on the terms agreed upon during the loan origination process.

Consequences of Defaulting on Loans

Individuals should be aware that defaulting on a loan impacts credit scores significantly, affecting their ability to secure financing in the future. Credit bureaus monitor payment histories closely, and a poor credit score could limit borrowing options or result in higher interest rates.

Moreover, the civil liabilities arising from unmet loan obligations could escalate into criminal liability in certain severe cases, considering the lender may invoke various legal provisions for recovery.

Maintaining Compliance to Avoid Legal Issues

To mitigate the risks associated with cheque bounce and loan defaults, individuals should educate themselves on the financial instruments they utilize. Maintaining clear communication with lenders and fulfilling repayment obligations is vital.

For cheque issuers, it is advisable to verify account balances prior to issuing cheques. For borrowers, establishing a structured payment plan can help manage repayments efficiently and avoid the consequences of default.

Educating oneself about the legal provisions and staying informed can play a significant role in ensuring financial compliance and a smooth relationship with creditors. Awareness about both the rights and responsibilities under related laws can lead to proactive management of financial commitments, allowing individuals to avert potential legal challenges such as those faced by Rajpal Yadav.