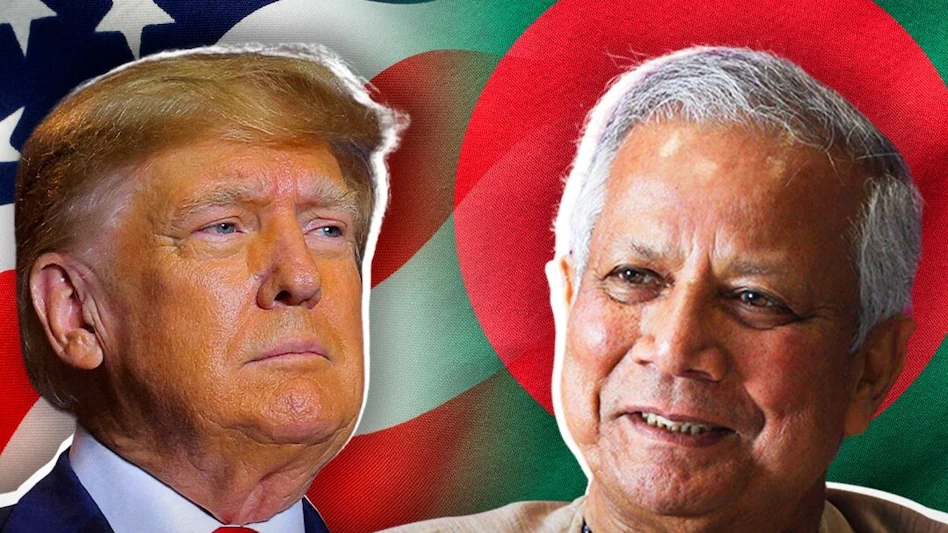

The United States has announced a reduction in tariffs for Bangladesh, bringing them down to 19%. This announcement follows a recent trade agreement between the US and India aimed at lowering tariffs on Indian exports. The new tariff rate for India is set at 18%, down from a previous high of 50%. This change has been welcomed by Indian textile exporters, as it positions them favorably compared to competitors such as Bangladesh, Pakistan, Vietnam, and China, which face higher tariffs.

Implications of the US-Bangladesh Deal

Despite the initial positive response among Indian exporters, the specifics of the US-Bangladesh trade deal have raised concerns within the Indian textile industry. In addition to lowering tariffs, the agreement allows certain Bangladeshi textile products to enter the US market at zero duty, but this is contingent on their production using American cotton and synthetic materials. This provision has the potential to impact India’s standing in the competitive US apparel market significantly, given that the US is a crucial destination for Indian textile exports.

India’s Textile Export Landscape

India’s textile exports to the United States amount to approximately $10.5 billion, constituting about 30% of all its textile and apparel shipments. Following the imposition of high tariffs, the sector, which contributes 2.3% to India’s GDP, experienced a notable decline in exports and faced challenges in managing large inventories. Recent statistics revealed a year-on-year drop of over 31% in textile exports to the US, further amplifying the sector’s struggles. The recent trade deal between the US and India provided some optimism, but the US-Bangladesh agreement could dampen that outlook.

Competitive Factors in Play

The implications of the US-Bangladesh trade agreement could significantly alter the competitive dynamics for Indian textiles. Although India benefits from a lower overall tariff rate compared to Bangladesh, the zero-duty status for Bangladeshi garments made with American cotton alters the competitive landscape. Indian textiles, subjected to an 18% tariff, may find it challenging to compete with the lower-priced Bangladeshi garments in the US market.

Impact on Cotton Exports

Another critical aspect of concern for Indian textile producers is the cotton-related exemption secured by Bangladesh within the new agreement. Bangladesh heavily relies on cotton imports for its textile manufacturing, being the largest cotton importer globally. Historically, a significant portion of India’s cotton exports was directed towards Bangladesh. However, recent political tensions have prompted Bangladesh to diversify its cotton imports from alternative sources such as Brazil and West Africa, and the new deal may compel Bangladesh to shift its focus even more toward American cotton.

Market Reactions

The immediate market reaction to the announcement of the US-Bangladesh trade deal has been notable. Stocks of Indian textile and spinning companies experienced a decline, reflecting concerns over the possible ramifications of the new competitive pressures. The dual impact of reduced cotton exports to Bangladesh and the zero-tariff advantage for Bangladeshi products in the US market poses significant challenges for Indian textile manufacturers.

As the final trade agreement with the US is still pending, there remains an opportunity for India to raise its concerns and seek concessions that could mitigate the effects of the US-Bangladesh trade deal on its textile sector.