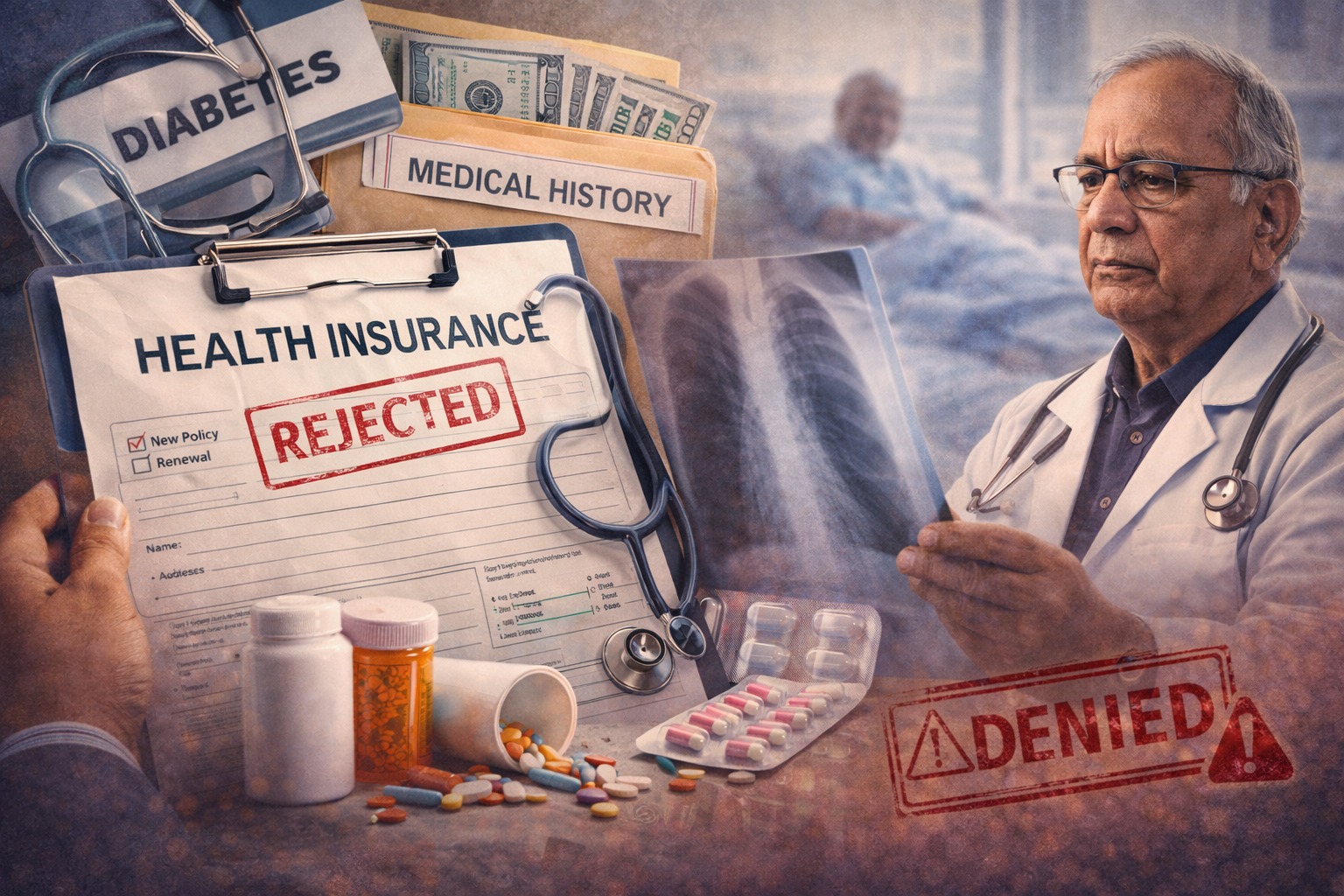

Concealing Pre-Existing Conditions in Health Insurance: A Risky Move

Related Articles

Retired ISRO Employee Allegedly Strangles Wife in Karnataka

A tragic incident in Karnataka has led to the arrest of a 65-year-old retired employee of the Indian Space Research Organisation (ISRO), Nageshwar Rao,...

So Now India-Bangladesh Relations Face ‘Test of Balance’ in New Geopolitical Era?

The political transition marked by Bangladesh’s general election of 12 February, 2026, represents not merely a change of government, but a broader moment of...

Promo Song of Bhooth Bangla Likely to Feature with Dhurandhar: The Revenge Ahead of April Release

As movie enthusiasts gear up for the release of Bhooth Bangla on April 10, 2026, excitement continues to build around the project featuring Akshay...