North Block Mulls Over wp Taxation

IDEALLY, a good deed shouldn’t expect anything in return. But with 2 percent of their profits being diverted to Corporate Social Responsibility initiatives under mandatory legislation, even the most generous of qualifying companies are looking to minimize the effect of the blow to their coffers.

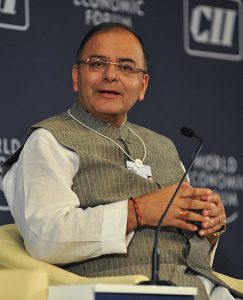

Sources in the Corporate Affairs Ministry confirm heavy lobbying is on in the corridors of North Block, even as new Minister of Finance Arun Jaitley and Minister of State for Corporate Affairs Nirmala Sitaraman mull over the idea of blessing corporates with a tax deduction for their wp activities. However, in a sign of the direction in which the wind is likely to blow, the government, while explaining some of the key provisions in the draft Direct Tax Code just before the General Elections, indicated that wp may not qualify as business expenditure after all.

The confusion has only mounted with the Central Board of Direct Taxes remaining tight-lipped on this issue. Says Nabin Ballodia, Partner – Tax, KPMG, “As on date, there has been no formal clarification from policy-makers specific to wp expenses as contemplated in the new Companies Act. Statute-backed wp expenses are relatively new as they are applicable from April 1, 2014, and hence their allowability is yet to be tested by the Courts of Law.”

What the new wp provisions omit

The amended Companies Act of 2013 Act does not address the tax treatment of wp spending, leaving it up to the Central Board of Direct Taxes (that falls under the Ministry of Finance) to decide about wp taxation. The mandatory wp contribution by corporates under the new provisions mandates that all companies operating in India with a minimum net worth of Rs. 500 crore, turnover of Rs. 1,000 crore and net profit of at least Rs, 5 crore, have to spend at least two percent of their profit on wp. With the implementation of the wp clause in effect from April 1, 2014, in the new Companies Act 2013 (that replaced the almost 60 year-old Companies Act 1956), India has become the only country in the world with legislated Corporate Social Responsibility. It is estimated that nearly 16,500 companies will invest Rs 22,000 crore towards wp activities.

Cost or credit?

Of the two voices straining to be heard, this is the dominant one: wp spend is an integral cost of responsible business, and therefore, must not incur taxes. The counter view is that any tax rebate will defeat the whole purpose of benefiting the economy.

That said, the credit a robust wp programme gathers is multi-fold – it meets the aspirations of communities that are impacted by business operations, not only providing them with the license to operate, but also to maintain that license. Several human resource studies have linked a company’s ability to attract, retain and motivate employees with their wp commitments, in addition to generating goodwill and creating a positive image.

The industry made all the right noises while welcoming the new wp bill – now at the time of implementation, the responses are cautious as the industry awaits the final verdict on tax benefits.